Intercom and broadcast management

Enable uni/bi-directional communication at your entrances or interior spaces for announcements and two-way calls.

Managing security across your financial institutions and bank branches isn’t simple. You might be facing cybercriminals, ATM fraud, loitering, false alarms, and aging systems that don’t always connect.

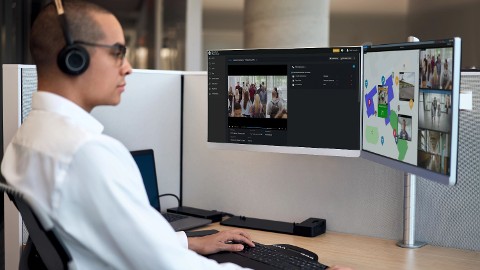

Simplify your security management. Combine video surveillance, access control, and analytics in a single, open system that works with your existing equipment. Security managers save time with an intuitive solution, fraud teams spot threats early, and IT teams get automated updates that keep systems up to date.

Everything’s interconnected and cybersecure, delivering real-time visibility and uninterrupted operations—all from one place.

Locate a person or vehicle by describing them in plain language. Intelligent search capabilities make it easy to search through days of video in seconds, helping you close cases faster.

By bringing together video surveillance and access control, you can validate alarms and take the right action at the right time.

When you unify transaction data with video, you can pinpoint relevant footage in minutes and investigate ATM transactions efficiently.

Enable uni/bi-directional communication at your entrances or interior spaces for announcements and two-way calls.

Get instant alerts if anyone tries to break in by linking video with intrusion panels.

Securely collect, manage, and share digital evidence across branches with law enforcement.

Keep traffic flowing smoothly with AutoVu™ automatic license plate recognition.

“Genetec has always been able to adapt to meet our needs by integrating new technologies and constantly improving its systems.”

Frédéric Mayer, Head of Physical Security, Banque de Luxembourg